DOE Wind Vision Report: More Wind Development Opportunities for Minnesota; Consumer Benefits of $2.54 Billion in Electricity Bill Savings Through 2050

Wind industry presents ceremonial check representing wind energy production tax payments to the region

SLAYTON, MINN., (November 12, 2015) – Today, representatives from the wind industry presented a ceremonial check to the Southwest Regional Development Commission and the Rural Minnesota Energy Board representing $7,224,246 in wind energy production tax revenue for 2014 to the counties of Cottonwood, Jackson, Lincoln, Lyon, Meeker, Murray, Nobles, Pipestone, and Rock.

“Rural Minnesota benefits from more

than $56 million in wind

energy production tax payments that have been paid over the past decade,” said Representative Joe Schomacker. “That

revenue helps hold the line on property taxes, helps pay for road improvements,

and helps support community projects throughout Greater Minnesota. Our

region is a clean energy leader and our citizens benefit from the jobs and

economic development that comes from wind development. We need to support wind energy

development in Minnesota.”

“Rural Minnesota benefits from more

than $56 million in wind

energy production tax payments that have been paid over the past decade,” said Representative Joe Schomacker. “That

revenue helps hold the line on property taxes, helps pay for road improvements,

and helps support community projects throughout Greater Minnesota. Our

region is a clean energy leader and our citizens benefit from the jobs and

economic development that comes from wind development. We need to support wind energy

development in Minnesota.”

“Since the first counties came together in the early nineties to address wind development issues, local governments in southwest Minnesota have been at the forefront of policy work supporting wind development," said SRDC Executive Director Jay Trusty. “From the creation of a model wind ordinance to the passage of the wind production tax, they have promoted the development of wind as an economic tool to take advantage of a local resource and provide benefit to the residents of southwest Minnesota.”

The development of wind energy projects is welcome in Southwestern Minnesota. “Producing clean energy helps Minnesota become energy independent, and also benefits local landowners who are part of the projects,” said Gene Metz, Legislative Chair of the Rural Minnesota Energy Board. “In addition, our entire community will benefit from the production tax revenue. Counties in this area use the wind production tax revenue for things like repairing county roads, bridges, and some building projects.”

“Wind facilities provide many long-term high quality jobs for service technicians and support staff to maintain and operate the site,” said David Easler, Senior Plant Manager at Vestas America. “Currently Vestas employs over 80 people in Minnesota and this grows as new wind projects are developed. Vestas is currently installing 100 new wind turbines in Cottonwood and Jackson County at the Odell Project, adding 12 long-term full time jobs.”

Earlier this year, the Department of Energy released its Wind Vision report. Nationwide, the report projects that wind power can supply 10% of America’s electricity by 2020, 20% by 2030, and 35% by 2050 – all while delivering consumer savings worth billions of dollars a year. In Minnesota, there is enough wind energy resource to power the equivalent of 1.3 million average American homes by 2030. The report also shows that achieving the Wind Vision would provide Minnesota with electricity bill savings of $2.54 billion, cumulative through 2050.

In addition, federal policies like the Clean Power Plan are providing another opportunity to capitalize on Minnesota’s great wind resource. “Minnesota and several of our neighbors, especially Iowa and other states in the heartland of the country, stand to benefit greatly from the Clean Power Plan because this low-cost, renewable energy resource can be exported to other states,” said Chris Kunkle, regional policy manager for Wind on the Wires. “We can benefit from the jobs, economic development and wind energy production tax payments; and, since the Wind Vision report predicts significant electricity bill savings from the use of wind, we can benefit in our household budget, too.”

Minnesota has been a leader in supporting the growth and development of wind energy. Currently, Minnesota ranks in the Top 10 in the nation for installed wind capacity, and percent of total state electric generation from wind.

The wind industry has invested $5.7 billion into Minnesota’s economy. With 3,035 megawatts of installed wind capacity, wind power now provides 15.9% of Minnesota’s electricity.

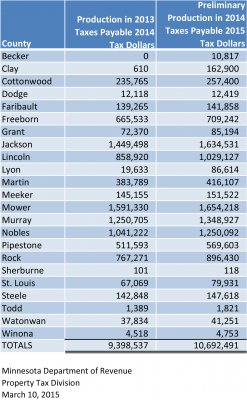

Wind energy supports more than 1,700 well-paying wind-related jobs and 124 wind power businesses in the state. For the first time, the revenue from the Wind Energy Production Tax exceeds $10 million. More than one-quarter of the counties in the state benefit from this revenue source, especially in Greater Minnesota.

L-R: David Easler, Joe Schomacker, Jay Trusty, Gene Metz, and Chris Kunkle.

# # #

About Wind on the Wires

Wind on the

Wires is a 501(c)(3) nonprofit organization based in St. Paul, Minn., which is

comprised of wind developers, environmental organizations, tribal

representatives, public interest groups, clean energy advocates, farm groups

and businesses providing goods and services to the wind industry. Our mission

is to overcome the barriers to bringing wind energy to market by addressing

technical and regulatory matters, as well as through education and public

outreach.