Ensuring Fair Play in Indiana's Energy Boom

| Emily Piontek, Regulatory Associate |

Man springing ahead over bar chart

Man springing ahead over bar chart | Emily Piontek, Regulatory Associate |

America is facing a new frontier in energy. We are living in a time of unprecedented growth and demand for energy. A recent report by the American Clean Power Association and the Brattle Group anticipates electricity demand could increase 35-50 percent by 2040. Near-term drivers such as the dramatic increase in data centers prompted by the growth of AI and new domestic manufacturing are fueling this demand. Add to that such longer-term drivers as electric vehicles, electric home appliances and heating systems, not to mention the plethora of gadgets that need continual charging, and you can clearly see that we need more energy; and we need it now.

This emerging demand presents significant opportunities for electricity generators to step up and contribute to the economic development in the region. Naturally, everyone wants to jump on this energy-boom bandwagon, including utilities and independent power producers (IPPs). But how generators plan to serve this need is a critical question with long-term implications for the energy transition.

A proceeding currently before the Indiana Utility Regulatory Commission (IURC) provides a case in point. NIPSCO GenCo (GenCo) is a newly formed affiliate of the Northern Indiana Public Service Company (NIPSCO), the largest electric utility in Indiana. GenCo was created to exclusively serve data center customers with demand of 100 megawatts (MW) or more ("mega load customers") locating in NIPSCO's service area. GenCo is seeking regulatory relief that would enable the company to bypass the IURC's approval process for new generating facilities, among other regulatory requirements, purportedly enabling the company to provide energy for data centers more quickly. However, GenCo's proposal could negatively impact regional power market dynamics and suppress competition from IPPs, including those developing clean energy.

The rise of AI requires mega-loads of energy

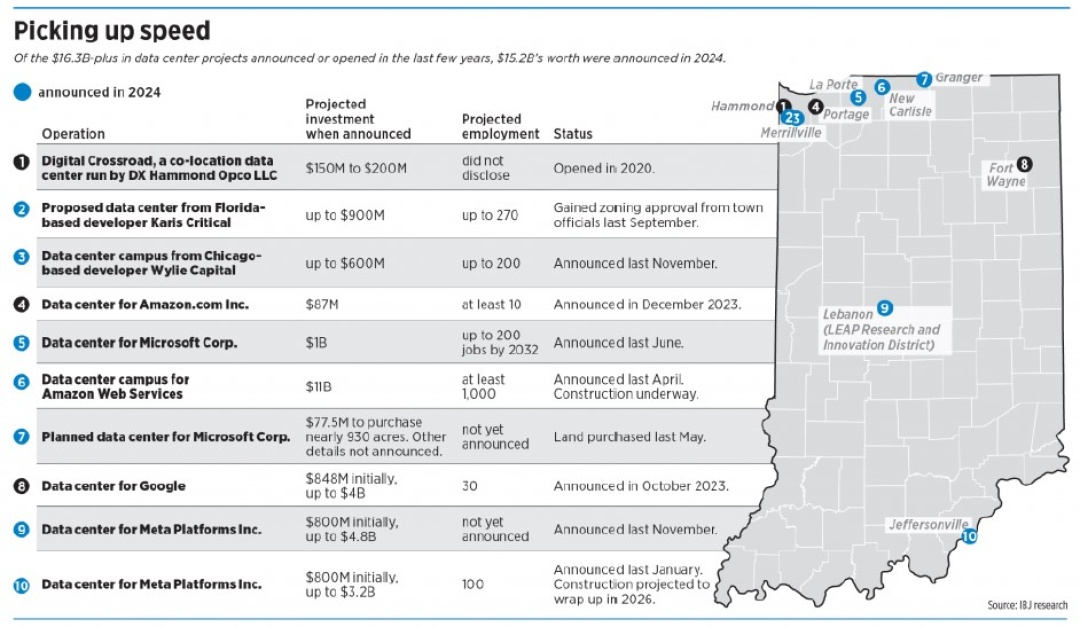

NIPSCO's 2024 Integrated Resource Plan (IRP) projects significant future load growth as evidenced by over 30 inquiries from new large load customers in the previous year, with more coming in. The utility projects 2,600-8,600 MW of load growth will materialize by 2035, entirely due to data center development in northern Indiana. For context, this means that at summer peak, data center customers would comprise at least 50% of NIPSCO's demand.

Developers are interested in northern Indiana for many reasons, including its proximity to Chicago, Indiana tax policy and economic development incentives, and the region's geography. GenCo aims to capitalize on this projected demand from NIPSCO's mega load customers by procuring all energy and capacity to meet those data centers' needs. In other words, GenCo would be the sole supplier of NIPSCO's mega load customers.

Need for speed

Developers are eager to bring data centers online quickly, but the generation needed to supply these power-hungry facilities can take years to procure – meaning "speed to market" for energy resources is crucial. NIPSCO, like other utilities, is motivated by the "need for speed" to attract and serve new mega load customers. Enter GenCo's "speed to market" strategy, which seeks to bypass regulatory oversight for all future projects, including over the need for Certificates of Public Convenience and Necessity (CPCN).

If approved, GenCo would earn a several-month head start in bringing projects online by avoiding this often-lengthy regulatory proceeding. While such exemptions have been available upon petition under Indiana's "declination of jurisdiction" statute for decades, previous requests have narrowly focused on distinct projects. There is no doubt that if GenCo is granted broad regulatory relief for all future projects, the company would have a significant advantage over IPPs that must go through the normal regulatory process on a project-by-project basis. Thus, GenCo's strategy jeopardizes the ability of IPPs to compete fairly for the opportunity to supply Indiana new data centers.

Furthermore, GenCo's strategy could enable the company to get its generation projects into MISO's notoriously bogged down interconnection queue ahead of IPPs still navigating the IURC regulatory process, firming up GenCo's competitive advantage. And, without having to demonstrate discrete project "need," GenCo could produce energy and capacity above what is needed to serve NIPSCO's mega load customers. A single data center customer can require hundreds to thousands of megawatts, but if a data center fails to materialize after a generation project is underway, those excess megawatts would flood the market. Ultimately, GenCo could over-supply generation and suppress the opportunity for IPPs to enter the market and compete for non-mega load business as well.

You can't have your cake and eat it, too

In its regulatory filing, GenCo explained that NIPSCO would both provide electricity to its mega load customers and be responsible for procuring power for those same customers through GenCo. GenCo would develop (and likely own) the generation assets. This arrangement streamlines the companies' operations, but it would likely lead to NIPSCO prioritizing GenCo's own generation assets – which would earn a higher rate of return for the entities' shareholders – over cheaper or more efficient resources from other providers. GenCo's petition does not directly answer whether it would invite bids from IPPs. It is also possible that NIPSCO would seek regulatory approval to purchase energy and capacity from GenCo to serve its non-mega load (retail) customer's needs if mega load demand is lower than anticipated, eliminating NIPSCO's need to negotiate with IPPs for even non-mega load demand.

Without competition from other market participants, rate payers may be subject to higher prices, poor service quality, and less innovation.

Putting the cart before the horse

GenCo is asking for relief from unplanned and undetermined resources that it believes will be needed to satisfy future unspecified contractual obligations to its affiliate, NIPSCO, for the energy and capacity needs of NIPSCO's anticipated mega load customers. That's a lot of uncertainty.

What is certain is that the demand from large-load data centers should be met through a fair and competitive process to ensure those customers have access to the lowest-cost resources that are fastest to build – often wind, solar, storage, and hybrid projects.

Where are the renewables?

Subscribe to our newsletter for the latest on energy & our work

Indiana's Energy Policy includes environmental sustainability as one of its "Five Pillars." Unfortunately, GenCo indicates it will serve the majority of its mega load demand with gas-fired generation rather than with storage and cleaner, lower-cost renewables. If IPPs developing wind, solar, and storage are unable to access the local market on a level playing field, affordability and environmental sustainability will be undermined, and over time, the remaining Five Pillars (reliability, stability, and resiliency) could also be negatively impacted.

The challenge of meeting this scale of data center demand is a relatively new issue for the energy industry, but other states are already exploring how clean energy can meet their unique needs. Nevada Energy (NV Energy) and Google just earned approval of a Clean Transition Tariff that will allow NV Energy, the local utility, to serve Google with geothermal energy. Google will pay the difference in cost compared to wind and solar alternatives. In approving Xcel Energy's recent long-term resource plan, the Minnesota commission ordered Xcel to propose a tariff for large load customers that will include clean energy provisions. And in Indiana, the IURC has already ordered Indiana Michigan Power (I&M) to work with stakeholders to develop a clean tariff for large load customers for regulators to consider this fall.

These examples illustrate that there are ways that regulators can ensure clean energy has an opportunity to serve this new demand.

The bottom line

To ensure there is fair play in Indiana's pending energy boom, there must be a competitive energy market to protect ratepayers and ensure clean, affordable energy can be part of the solution. GenCo's overly broad request for regulatory relief threatens to undermine competition in electric generation, leading to higher prices and less innovation.

Upholding the time-tested principle of competing for the privilege to do business is paramount. Before granting any regulatory relief, CGA recommends the IURC implement the following safeguards:

- Ensure fair competition by requiring a competitive Request for Proposal (RFP) process that includes renewable and storage resource procurement,

- Maintain progress on environmental sustainability by requiring GenCo to integrate clean energy into its generation portfolio, and

- Protect the public interest through appropriate IURC oversight that limits the scope of GenCo's ability to bypass the regulatory process.

Safeguarding IPPs will also safeguard the public interest, promote a healthy energy market, support Indiana's Energy Policy, and drive economic growth. This is what fair play looks like.